Lots of people ask me why I waste my time with all of those foolish facet hustles. To most individuals, it doesn’t make a lot sense that somebody like me – a lawyer with a superbly good job – would spend my free time doing issues like delivering meals to individuals, renting out a room on Airbnb, or promoting trash that I discover on the street. It makes even much less sense that I do that stuff when you think about the truth that my spouse is a dentist. Individuals with my background simply aren’t presupposed to be doing work like this.

Admittedly, these facet hustles don’t make me a ton of cash – a minimum of not within the conventional sense. Positive, I could make an additional couple thousand {dollars} in a 12 months. In reality, final 12 months I remodeled $14,000 doing a bunch of various facet hustles that just about anybody can do. An additional $14,000 in a 12 months is good, but it surely isn’t going to be sufficient for me to reside on. Within the grand scheme of issues, it appears fairly small.

However, like with most issues within the private finance world, there’s rather more than meets the attention. We already know in regards to the impression of a “dumb” facet hustle over the long run. As I’ve mentioned earlier than, somebody making only a few further hundred bucks per thirty days (which ANYONE can do in at this time’s economic system) can flip that facet earnings into an enormous, six-figure sum later down the road. Not dangerous for a “dumb” facet hustle.

For these of you within the monetary independence/early retirement camp, these dumb or foolish facet hustles are price considerably greater than you assume. You don’t even want to offer it 30 years to develop. Relying on how a lot you may make in a 12 months, your dumb facet hustle – the one which your entire mates make enjoyable of you for doing – may very well be price six-figures proper now! How can this be?

The key lies within the 4% rule and the quantity that it is advisable have saved in your nest egg. Let’s take a more in-depth look.

The 4% Rule

Earlier than we leap into the underrated worth of the facet hustle, we have to discuss a little bit bit about probably the most well-known rule within the monetary independence/early retirement group – the 4% rule.

Damaged down, the 4% rule is fairly easy. It principally says which you can spend 4% of your nest egg annually and, in idea, it ought to final you for the remainder of your life. Thus, when you’ve got $1 million {dollars} saved up, you’ll be able to pay your self a $40,000 per 12 months wage for the remainder of your life (4% of $1 million {dollars} equals $40,000).

This determine isn’t made up both. It comes from the Trinity Research, which is principally a research by a bunch of professors that decided this secure withdrawal price. In virtually all situations, withdrawing 4% over 30 or extra years ought to end in you by no means operating out of cash. As defined within the research, with a 3% or 4% withdrawal price, “portfolio success appears near being assured.”

There’s clearly extra nuance to it than that, however the level is fairly easy within the monetary independence/early retirement world. Determine what you spend yearly and multiply that quantity by 25. That’ll provide the quantity that it is advisable have saved so to withdraw 4% out of your nest egg yearly.

In the event you spend $40,000 per 12 months, you’ll want $1 million {dollars} to be able to be financially unbiased. In the event you spend $80,000 per 12 months, you’ll want $2 million {dollars}. And so forth, and so forth. Clearly, the extra it is advisable spend annually, the extra you’ll have to have saved.

How A lot Is Your Facet Hustle Truly Price?

The 4% rule is a good way to determine how a lot it is advisable have saved earlier than you’re financially unbiased, however what’s fascinating in regards to the rule is that it additionally tells us precisely how a lot a foolish facet hustle of ours could be price.

For instance, I discuss fairly typically about how I made $14,000 final 12 months utilizing sharing economic system apps. (In the event you haven’t already, take a look at my facet hustle reviews so to see the entire bizarre methods I’ve been capable of earn cash on the facet). Utilizing the 4% rule, it could take me $350,000 to be able to generate that very same $14,000. In different phrases, if I can work out easy methods to earn a mere $14,000 per 12 months, I can forego saving $350,000 in my nest egg! That’s fairly unimaginable.

Simply check out how a lot much less you want in your nest egg in the event you can pull in only a few thousand {dollars} of earnings in a 12 months via a dumb facet hustle.

Facet Hustle Earnings Per Yr Worth To Your Nest Egg $1,000 $25,000 $2,000 $50,000 $3,000 $75,000 $4,000 $100,000 $5,000 $125,000 $6,000 $150,000 $7,000 $175,000 $8,000 $200,000 $9,000 $225,000 $10,000 $250,000 $11,000 $275,000 $12,000 $300,000 $13,000 $325,000 $14,000 $350,000 $15,000 $375,000

The numbers are fairly astounding on shut inspection. Each $1,000 which you can earn in a 12 months is price $25,000 of retirement financial savings. Somebody who can work out a technique to make a measly $5,000 per 12 months on the facet can get away with having $125,000 much less saved up.

$5,000 in a 12 months is simply $96 per week. That’s it. You solely have to determine easy methods to make $96 per week and consequently, you gained’t have to avoid wasting an additional $125,000! I promise you that anybody can work out a technique to make an additional $96 per week in the event that they actually give it some thought.

For the tremendous Mustachian of us on the market who can spend simply $25,000 or so per 12 months, it might theoretically be potential to reside a superbly nice life by saving up $250,000 and making an additional $15,000 per 12 months delivering meals in your bike or internet hosting individuals in a spare room in your own home. I do know a bartender who’s at the moment 30 years previous that might simply do that. Possibly it’s not monetary independence within the conventional sense, however figuring out that you simply solely have to make an additional $10,000 or $15,000 in a 12 months to be able to survive is a reasonably good place to be in.

Takeaways

In the event you assume making an additional $10,000 or $15,000 in a 12 months is tough, I’ve to inform you, it’s actually not. I remodeled $14,000 final 12 months from renting out a spare room in my home, canine sitting, delivering meals on my bike, and flipping trash that I discovered on the street. And that was whereas I used to be working a full-time job and attempting to get this weblog off the bottom!

Think about how straightforward it could be to earn $10,000 or $15,000 in a 12 months if I didn’t need to work all day too.

As for methods you may make a number of further bucks in a 12 months, listed here are only a few of the issues I try this actually anybody can do:

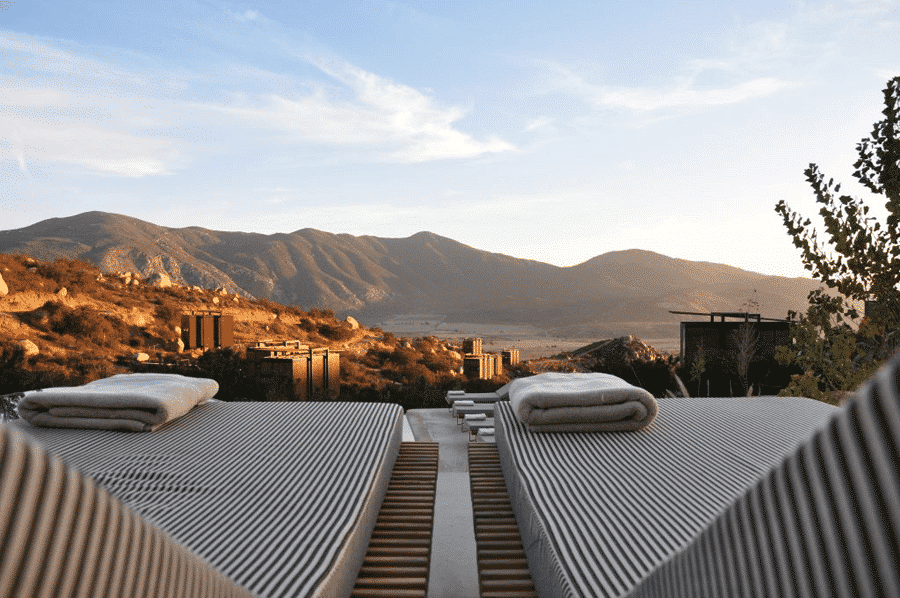

- Host individuals in a spare room in your own home on Airbnb. Even in the event you love your privateness, most individuals might in all probability host somebody for six days per thirty days. That’s it. In the event you lease out a room in your own home for 50 bucks an evening for six nights per thirty days, you’re making $300 per thirty days. Whole earnings in a 12 months = $3,600.

- Watch canine on Rover. A couple of days of canine sitting per thirty days ought to be good for a minimum of $100 per thirty days. Whole earnings in a 12 months = $1,200.

- Ship meals utilizing your bike with DoorDash, Uber Eats, and Grubhub. It’s not laborious to make $200 per thirty days doing this. That’s solely about $50 per week, which typically, comes out to only a few hours per week. It’s best to positively be exercising a minimum of a number of hours per week. Why not receives a commission when you do it? Whole earnings in a 12 months = $2,400.

- Cost electrical scooters with Hen and Lime. In the event you reside in a metropolis and neighborhood that has electrical scooters, it’s not tough to make extra cash every month gathering and charging these scooters. On a current convention in Austin, I made $200 charging scooters in my Airbnb. Most months after I was charging scooters, I simply made a number of hundred with little or no work. In the event you make $200 per thirty days, you’ll find yourself with $2,400 in a 12 months.

Proper there, with out even attempting, you’re a complete of $9,600 of earnings in a 12 months. That $9,600 is price $24,000 to your nest egg. And that’s in the event you’re barely attempting.

With all this of knowledge, possibly that foolish facet hustle isn’t so foolish in spite of everything.